Scenario

The financial team of a large Brazilian multimodal logistics company sought to address some issues they had in the sector. Currently, they manage receivables from their customer portfolios weekly in spreadsheets, a laborious task that is necessary due to lack of automation. Additionally, they are responsible for presenting updated information to the company's board, where a team member is in charge of collecting, reviewing, and producing the presentation on time.

Goals

Automate processes

Reduce human errors in the process

Decrease fragility

Reduce average user time on activities

Eliminate employee task overload

The Analysis

CSD Matrix

How will we receive due date data for accounts receivable?

Is it necessary to map tables in the database to validate the data?

What are the rules for setting monthly and annual targets?

How to determine if the data is litigated, non-litigated, or intercompany?

What are the rules for defining services and on-demand purchasing services?

How does the logistics mesh overdue evolution chart work?

What are the month-end closing rules?

What are the rules for generating charts?

What will trigger the due date?

What are the rules for displaying companies in the evolution?

For users, is it more valuable to view the closed or current month?

Scenario analysis

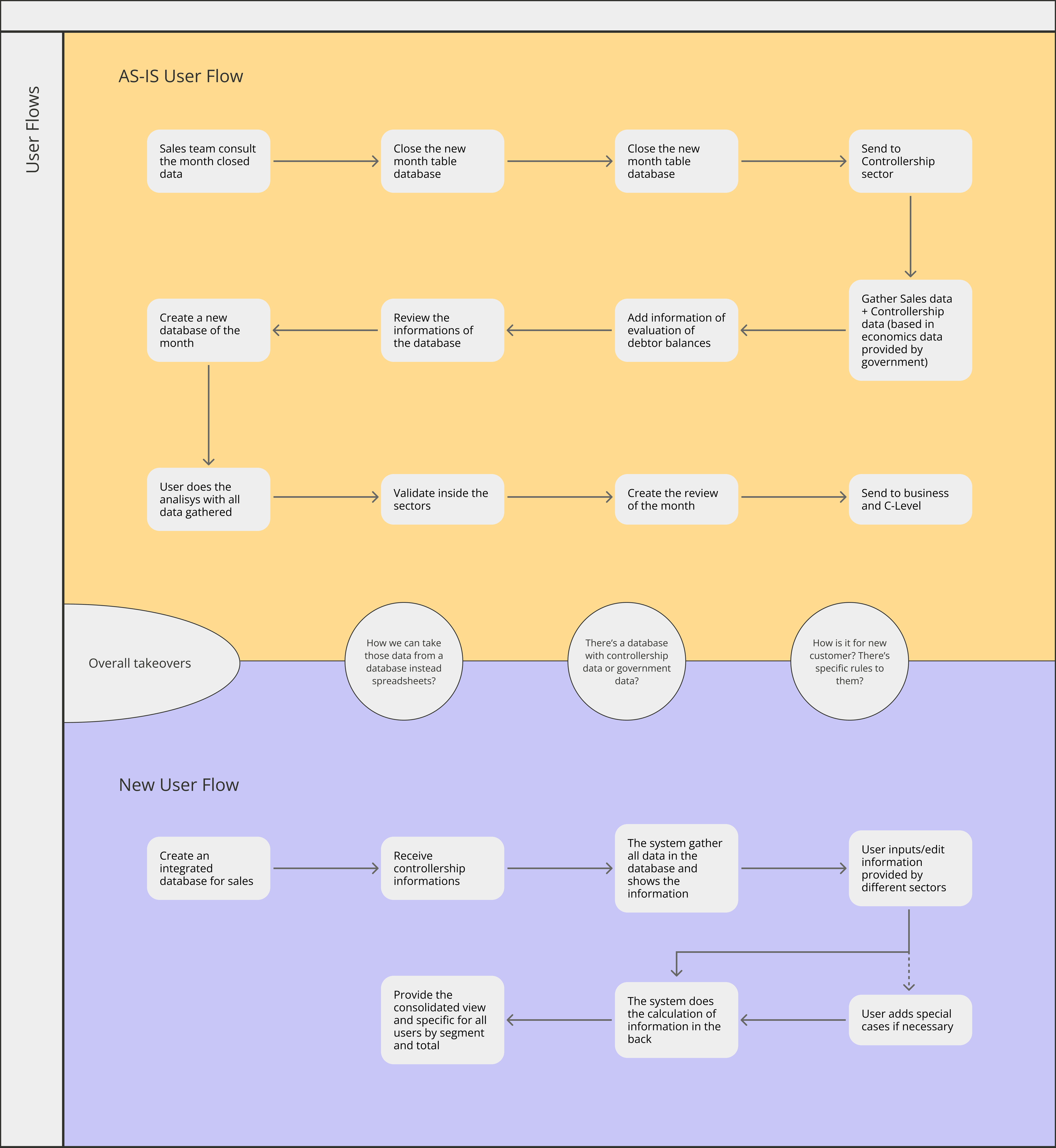

Analysis as-is today

To dive deep in the solution, we made an analysis of the current presentation the users need to prepare. The full analysis it's not in the case due the confidentiality terms.

Open values - open bills tree

They present the open accounts monthly for review

There is no specific information regarding the data source

Overdue dates are not standardized

They work with three main branches: judicialized or not and special accounts

There is no standard for special accounts, as they are based on customer relationships or special cases

The values are all above R$100,000; otherwise, they are considered special cases

There is a standard for overdue data: less than 2 years, between 2 and 5 years, more than 5 years

They follow the rules of IFRS 9.

Financial cash protection

They have overall insights from the month, separated by general and type of services

They need the evolution of the month

They gather information from all types of services and present them to the C-level

They have a default goal, and it is divided by overdue of the month and the total accumulated

They need to inform the gross revenue to generate the goal

They identify customers with the most open overdue bills and those who pay the most

They create a comparative vision of the year with the previous year

They need a vision for delinquency by type of services, with the possibility of an extended view

They need to have a view of customers with the most open overdue invoices.

The Solution

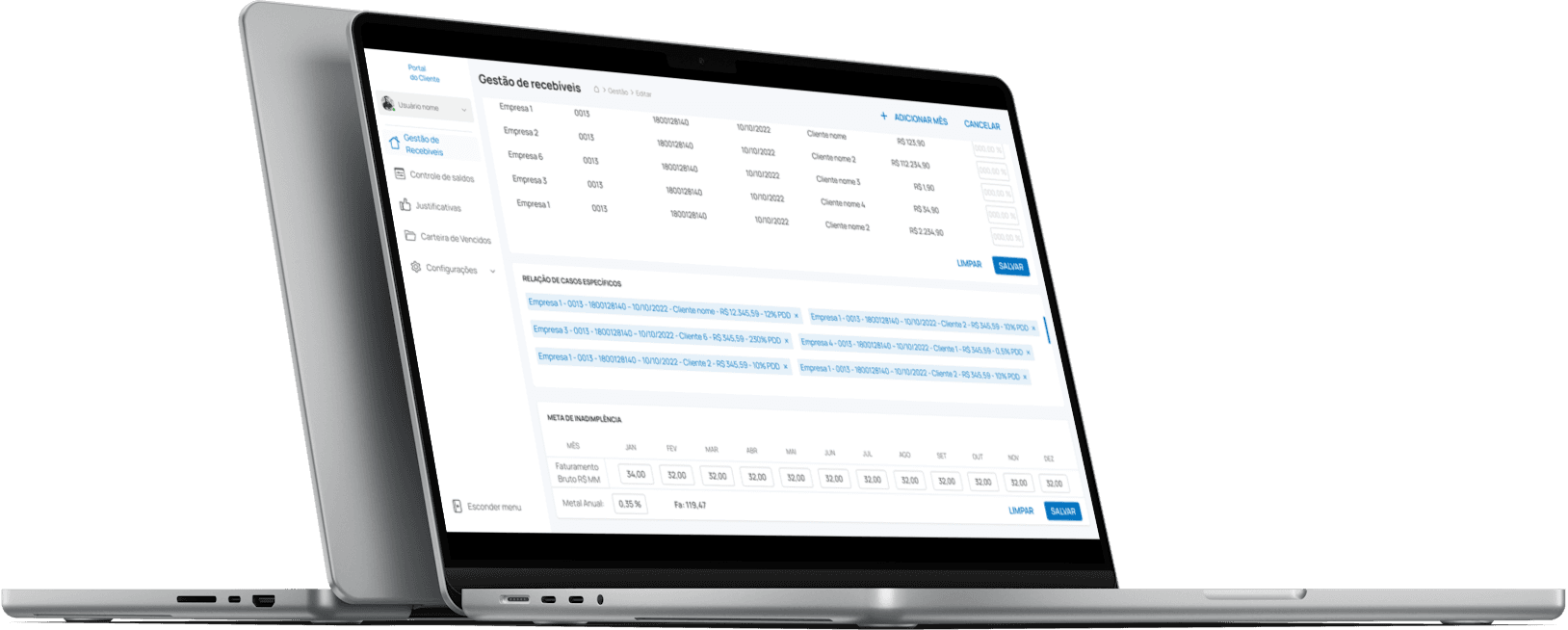

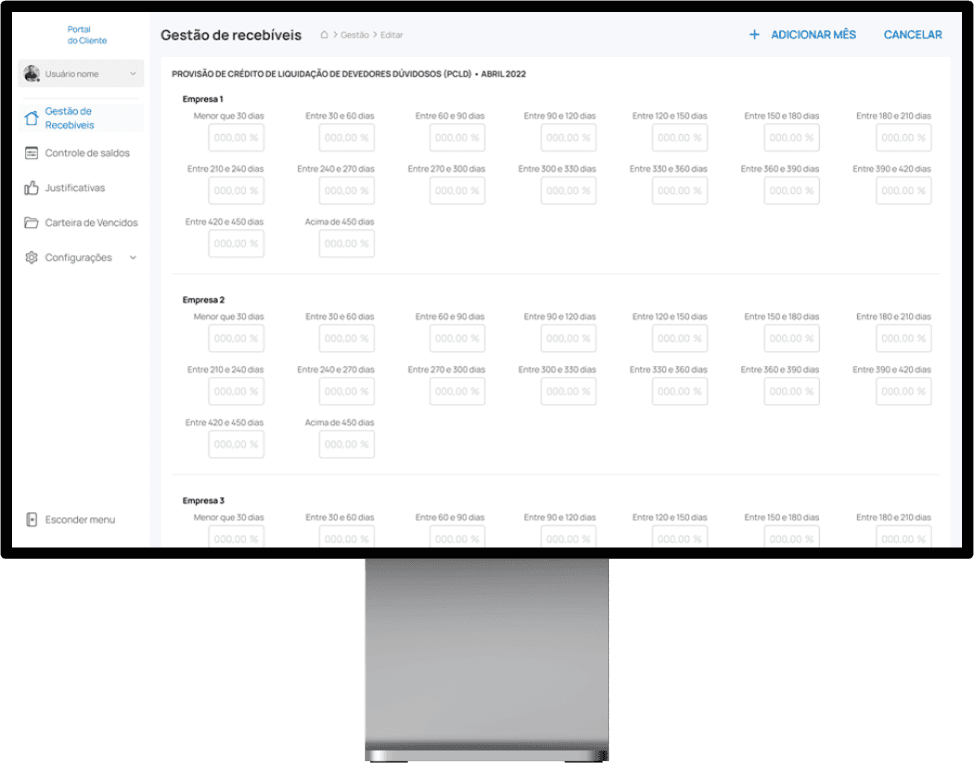

Prototype and final solution

The solution was created with collaboration of users, board and team. Developed to reduce the effort of sales team, the fragility of information and the security of data.